Budgeting. I used to hate this word. It felt restrictive and uptight, the opposite of how I wanted to feel: free and light.

I tried to use apps like Mint but it didn’t fit how I actually lived, and I would get confused about which category a purchase belonged to. Does a book go under “education” or “shopping?” I simply don’t categorize my life and spending in that way. Because I wasn’t able to fit my life into these predetermined boxes, it perpetuated my belief that I wasn’t good with money.

When I started to view money as energy and that we are the conductors who get to guide where it goes, it changed everything. I started to see budgeting as a map for my money.

Today, I’m sharing with you the budgeting system, or Money Map, I used that helped me embrace my relationship with money and get out of over $10k of credit card debt.

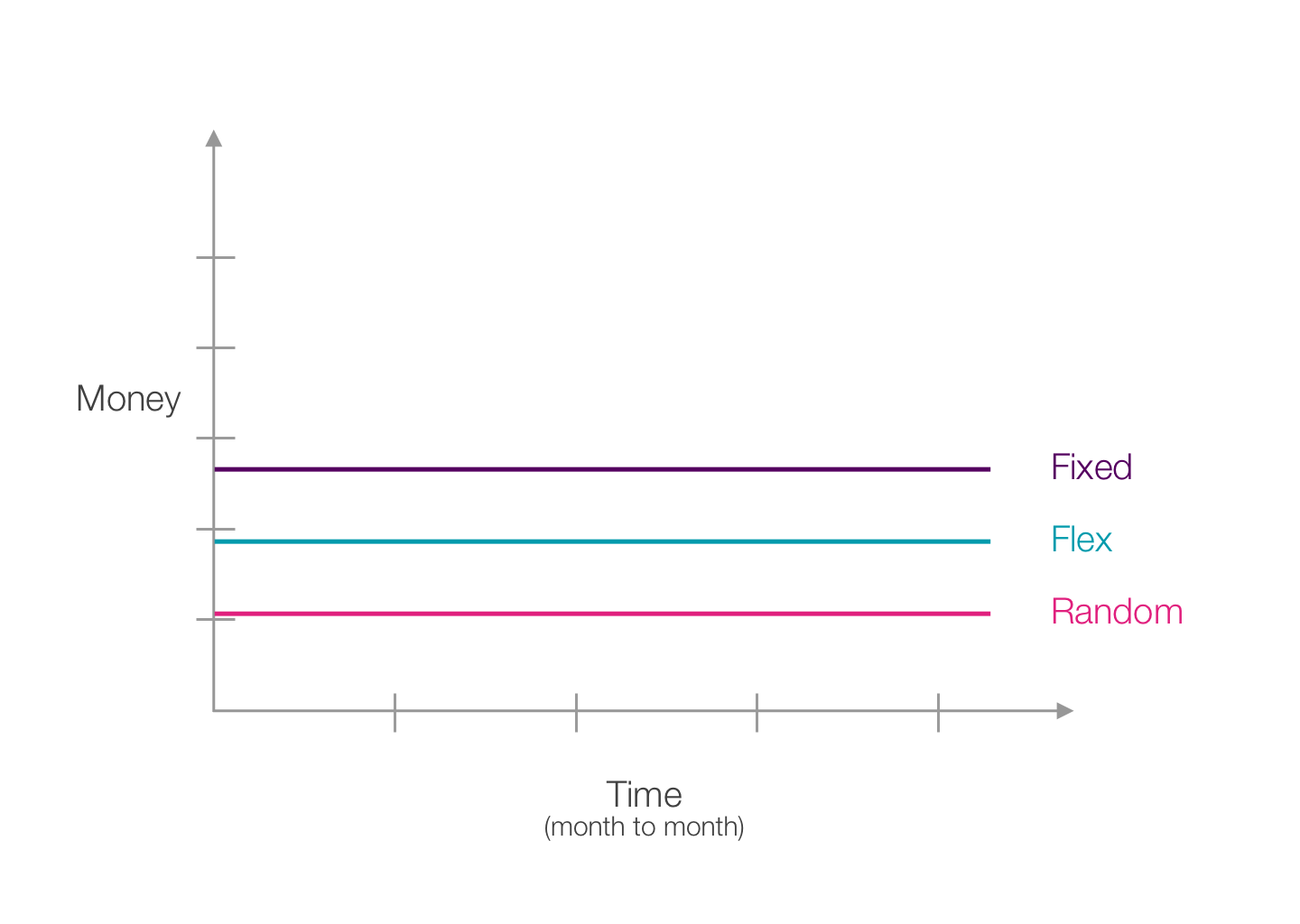

3 Types of Spending

Fixed Spending

Monthly expenses that stay the same from month to month.

Examples: rent/mortgage, utilities, health insurance, car payments, subscriptions like Netflix and Spotify, a set monthly credit card payment.

Flex Spending

Things you can expect to spend money on but varies from week to week, and month to month.

Examples: groceries, dining out, Uber rides, Starbucks, shopping, gifts.

Also- anything that you consistently money on could be its own category.

Example: if you buy a drink from Starbucks Monday-Friday, you can allocate $25 every week for Starbucks.

Random + Yearly Spending

We often overlook the things we only purchase once a year or that come at random. These purchases often don’t make it into a typical budgeting plan, but can add up to quite a bit. If you can save up for them throughout the year, then you will be less likely to be surprised when they come around.

Examples: Travel, Amazon Prime membership, credit card annual fee, car tune-ups.

Creating the Money Map

Get to know your money.

Take a look at the past 3 months of spending. Pull up all the bank statements, and write down every purchase. Yes. Every. Purchase. You can use a spreadsheet or good ol’ pen and paper.

If you use cash instead of plastic, can you find some receipts or at least track your ATM withdrawals? Can you recall what some of those purchases were?

While there are plenty of apps and programs out there to keep track of this, doing this manually allows you to connect with each purchase you’ve made.

Incoming Money

Regardless of whether you receive a regular paycheck or are a freelancer with variable income, determine how much you take home each week or month after taxes. Take a moment to express gratitude for what you receive.

Outgoing Money

Which purchases are Fixed? Which are Flex? Which are random or yearly?

Add up all your Fixed Spending. Remember, this amount stays the same each month.

Average your 3 months of Flex Spending.

For your Random + Yearly Spending, add in anything that wasn’t included in the past 3 months but should be, then find the monthly average.

Map it out

Our goal here is to become fully aware of the money that comes in and goes out and to make it more predictable from month to month.

This chart already feels like way less anxiety. When you know exactly how much is coming in and going out, you can better predict and plan.

You can break down the money map into weekly, bi-weekly, or monthly, whatever works best for you.

Let’s use an example.

After taxes, your take-home income each month is $4,000.

Your Fixed Spending is $2,000 a month.

Your Flex Spending is $1,000 a month.

Your Random Spending adds up to $500 a month.

This leaves you $500 a month to put into savings.

Awesome!

Or… maybe you discovered that you’re actually in a deficit after your spending. It’s okay. I’ve been there, where I thought I was making enough money, only to discover that I was spending wayyyyy more money than I was making without even realizing it.

This awareness is KEY and you are on your way to becoming friends with your money.

Freedom

When I ask people what money provides for them or how they want to feel with money, Freedom is the number one response.

When we try to budget, or map our money, within the constraints of categories, this creates restriction rather than freedom.

The Flex spending allows you to have a set amount to spend on whatever you want. When it’s gone, it’s gone. If you need to use more than your Flex amount was allocated for, you can pull it from savings. For me, this creates an extra barrier because I have to take an action to transfer money and ultimately, it prevents me from spending more than I have available.

Saving Money

What are you saving for? Having a goal for your money helps direct energy and intention towards it. It helps you get clear on what’s important to you and why.

Even if you are only able to save $10 a month, it’s making a statement to your subconscious and to the Universe that “hey, this thing I’m saving for is really important to me” and you may be surprised to find more money and opportunities open up along the way.

Setting up Bank Accounts

I have several accounts to separate my money so I don’t have to do a mental calculation every time I go to make a purchase. I can simply look at the appropriate bank account and know exactly how much is available to me. Chase Bank allows you to nickname accounts, so I named them something fun, positive, and encouraging.

Checking account for Fixed Spending.

Checking account for Flex spending. If it gets down to zero, that's it. No using the credit card. I can move money over from savings if I'm really in a pinch but I try not to do that. I call this account "Gratitude.”

Savings account for short-term things like a fun night out, a new pair of shoes, or whatever I might want to buy that's not included in my budget. I set up automatic transfers to this account. The names I’ve used have changed over the years from “Joy” to “Future Fun” to “I am Trustworthy.”

Savings account for long term goals. Big travel trips, down payment on a house. You name it. I set up automatic transfers to this account.

Savings account at a different bank for a “safety net.” The safety net is something that helps me feel financially safe and stable, knowing that I always have this amount just in case. I set up automatic transfers to this account until it reached my ideal number. There’s no “right” number. Experts recommend 3-6 months of living expenses. My “safe” number was $1,000. Someone else’s is $10,000. It's a personal preference.

You are the Driver

That’s right babe. You are the driver. You created the map and you get to guide your money and energy where it needs to go and where you want it to go.

Are you ready to implement this into your life?

Got questions?

I’d love to hear from you.

Are you looking for more healing to your relationship with money, abundance, receiving, and self-worth?

Join me for Diving for Treasure, a soulful exploration to create freedom and flow with money, starting on August 8, 2020.